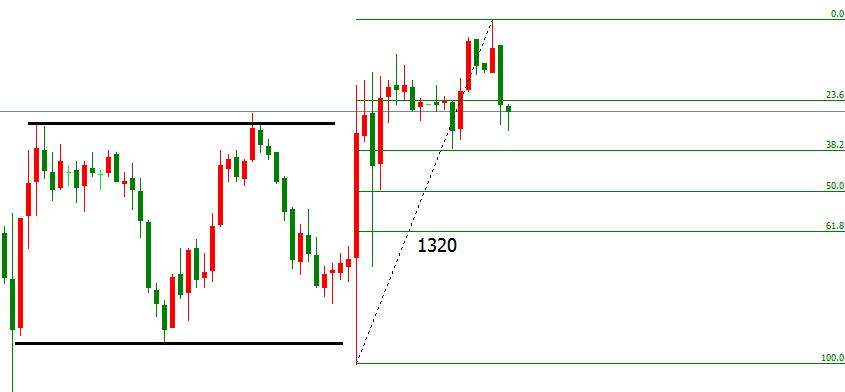

王垣鑫:金价走势反复关注1320

昨日观点日内整体区域震荡,震荡区间为1315-1325区间,但由于昨日在日线级别里面表现为冲高回落走势,若昨晚不能重新回到ma5上方收线,那么今明两天将大几率出现下破行情。短时间内1h级别kdj指标快线已经运行到0下方,1h级别宣布进入钝化下行节奏,ma5持续位于金价上方提供反压,每小时跌幅受限,下方重点关注1315一线支撑。建议1315附近做多,止损1312下方,目标1318-1319、1325;

从结果上来看,昨日金价晚间在短时间跳水回1315美元/盎司附近再度受支撑,出现短时间跳涨行情,20分钟内直接反转重回1315-1325区间顶端,随后经过短时间高位震荡后,又出现跳水回踩至昨晚涨幅黄金分割线61.8回撤位处再度跳涨,后市一度上探1330美元/盎司一线。

目前1h级别macd指标双线高位死叉,暗示短时间内行情趋于调整,日内关注1320美元/盎司一线,此处为1314上涨至1330的黄金分割线61.8回撤位,为多方回调的最后防线,一旦跌破则后市重新回到起涨点,并且从最近走势上看,金价保持10美元左右震荡,今日凌晨金价将震荡高点1325提升至1330,则下方10美元处为1320需重点关注。

操作建议:

空方支持者可现价激进轻仓空目标1320,止损1329.

稳健回撤1320附近做多,目标1324附近,1330附近,止损1316.

本文来源: 大田环球贵金属

最新内容

相关阅读

Risk Warning

Trading bullion and financial instruments carries significant risks and may not be suitable for all investors, requiring careful consideration of investment objectives, experience, and risk tolerance. Key risks include market volatility, leverage risks that can amplify gains or losses, liquidity issues that may prevent executing trades at desired prices, and technical failures in online trading systems. Prices fluctuate unpredictably, and past performance does not guarantee future results. CIDT Global Bullion Limited provides general market commentary but does not offer investment advice and is not liable for any losses incurred from reliance on its information, which may change without notice.

Jurisdiction Disclaimer

CIDT Global Bullion Limited's services are subject to local regulations and may not be available in all jurisdictions. Users are responsible for ensuring compliance with their local laws. Services are not provided in regions where they are prohibited by law, under international sanctions, or require licensing that the company does not hold. By using the platform, users confirm they are not in a restricted jurisdiction and accept full responsibility for legal compliance. The company reserves the right to decline or terminate services in restricted areas without prior notice.